I had the privilege of doing two panels at Phoenix Comicon this year: Fan Art/Fiction and Fair Use and Comic Book Creator Rights. The latter was a panel with writer/artist Josh Blaylock. He has experience licensing others’ work and creating his own.

Someone in the audience asked us how much a person should set aside to cover legal fees when starting a comic book.

Create Quality First

If your goal is to create a comic book and possibly a business from it, start by working on your craft. You won’t have any legal issues if no one cares what you’re making.

Start with a Consultation

When you’re ready to take your work from a hobby to a professional endeavor, schedule a consultation with a lawyer. Choose someone with experience in entrepreneurship and intellectual property – business formation, copyright, contracts, and trademarks. You need someone who can help you understand when you need a lawyer. Expect to pay $200-350/hour for a lawyer’s time, more depending on where you live and the person’s experience level.

It doesn’t cost much to get started with a new venture, but you do want to be thoughtful about what you can afford and act accordingly. A good lawyer will respect your budget and tell you what you can do on your own, and when it’s imperative to hire a lawyer. For instance, in many states, it’s easy to file your own business entity. Check with your state’s corporation commission for instructions and the forms. In Arizona, you can file an LLC and complete the requisite publication for less than $100.

Protect your Intellectual Property

The most valuable asset in your work is your intellectual property. Before you fall in love with a name for your comic book, run a search on the USPTO trademark database to verify that someone else hasn’t claimed the same or a similar name. Even if you can’t afford the $225-325 filing fee to register your trademark at first, you can put a superscript “TM” next to your work’s name, logo, and anything else you claim as a trademark. The USPTO has videos about how to submit a trademark application if you want to try to file your own, but I usually recommend that clients have a lawyer shepherd their application through the process. If you want to do this, expect to pay an additional $1,000 for their time.

In regards to copyright, I tell my clients, it’s not if your work gets stolen, but when so plan accordingly. For a new comic book creator, my recommendation is to register each edition with the U.S. Copyright Office. Their website is not the most user-friendly experience, but you can hire a lawyer for an hour to walk you through your first registration and then you can submit your subsequent copyright applications by yourself. The filing fee for a single work is $35-55.

Manage Relationships with Contracts

Every relationship related to your business should be documented with a written signed contract. This applies to co-owners of your business, writers, artists, colorists, licensors, licensees, vendors, and if your comic book turns into a job offer, your employment contract. Contracts are relationship-management documents. They keep everyone on the same page in regards to expectations, compensation, ownership, and they provide a course of action if there is ever a dispute. A contract is an investment and worth the cost to hire a competent lawyer to write or review your document to ensure it is effective for your needs.

Additionally, every entrepreneur should watch the video Fuck You, Pay Me, featuring Mike Monteiro and Gabe Levine. They have excellent advice for all entrepreneurs, especially those who work in creative services.

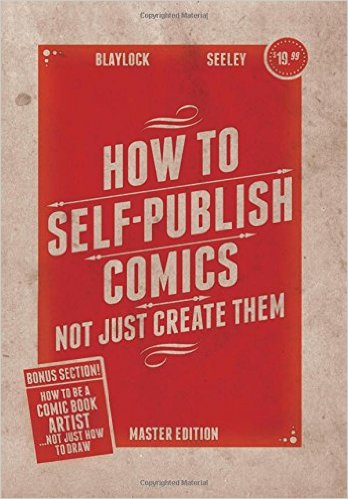

If you want more information about the nuts and bolts of starting a comic book, check out Josh Blaylock’s book How to Self-Publish Comics: Not Just Create Them. If you want more information about the legalities of starting a business or working in the creative arts, you can contact me directly or connect with me on Twitter, Facebook, YouTube, or LinkedIn. You can also get access to more exclusive content that’s shared only with my mailing list, by subscribing to the firm’s newsletter.